derivative instrument finance definition

Derivative instruments enable investors to hedge their portfolios against adverse price movements which can result in unexpected losses. A financial instrument derivative is a financial instrument whose value or performance is derived from or reliant on the fluctuations of the value of an underlying group of assets such as commodities bonds stocks currencies interest rates and stock market indices.

Financial Instrument Definition Types Example Of Financial Instruments

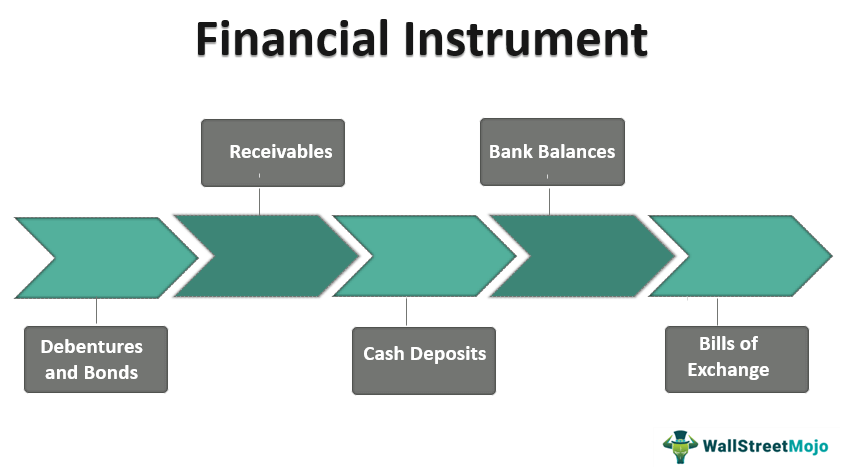

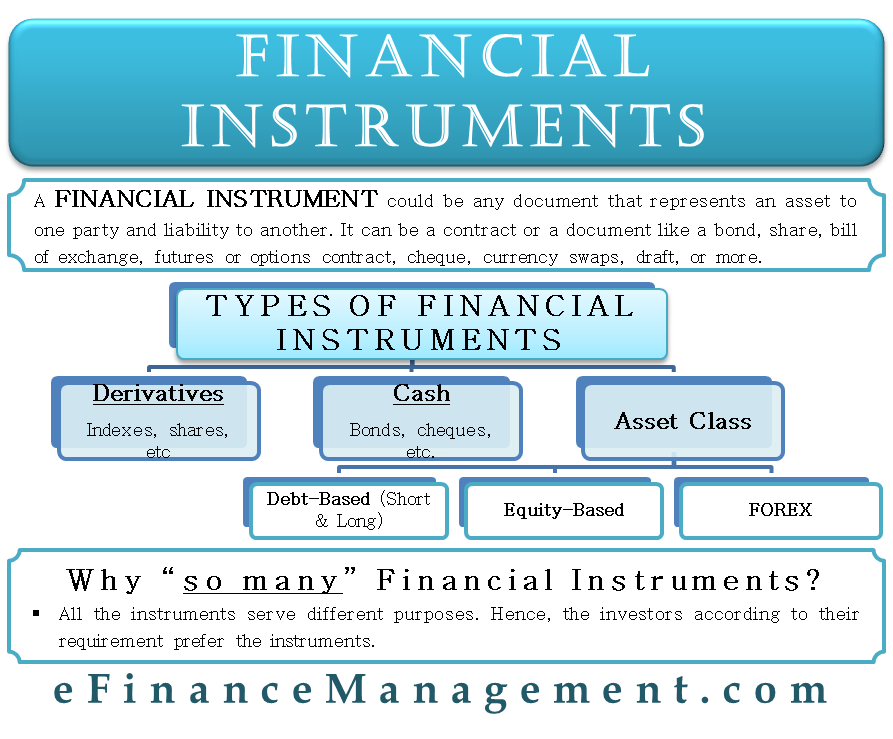

The most common examples of financial assets are bank deposits shares trade receivables loans receivables.

. Derivatives are often used for commodities such as oil gasoline or gold. Another asset class is currencies often the US. The definition of commodity forwards that can be physically settled.

Ii a derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entitys own equity instruments. A derivative is a financial instrument that has the following characteristics. Calculation Mechanism of Derivatives Instruments in Finance.

Definition of a financial liability. In order to avoid the inconsistent application of EMIR across the EU ESMA understands that. When the value of the underlying factor changes the value of the derivative instrument changes.

A derivative is a financial instrument. Derivative security A financial security such as an option or future whose value is derived in part from the value and characteristics of another security the underlying asset. Investopedia defines a derivative financial instrument as a contract between two parties in which the contracts value is determined by the fluctuation in value of an underlying asset.

Derivative instrument - a financial instrument whose value is based on another security derivative legal document legal instrument official document instrument - law a document that states some contractual relationship or grants some right. The underlying asset can be commodities stocks interest rates market indices bonds and currencies. There is at least one notional amount the face value of a financial instrument which is used to make calculations based on that amount or payment provision.

Derivative instrument financial definition of derivative instrument Derivative security redirected from derivative instrument Also found in. In the definition of financial asset derivative instrument is covered under c ii viz to. A derivative that is attached to a financial instrument but is contractually transferable independently of that instrument or has a different counterparty is not an embedded derivative but a separate financial instrument IFRS 9431.

I the frontier between spot and forward. It is a financial instrument or a contract that requires either a small or no initial investment. Characteristics and risks not closely related Definition of closely related.

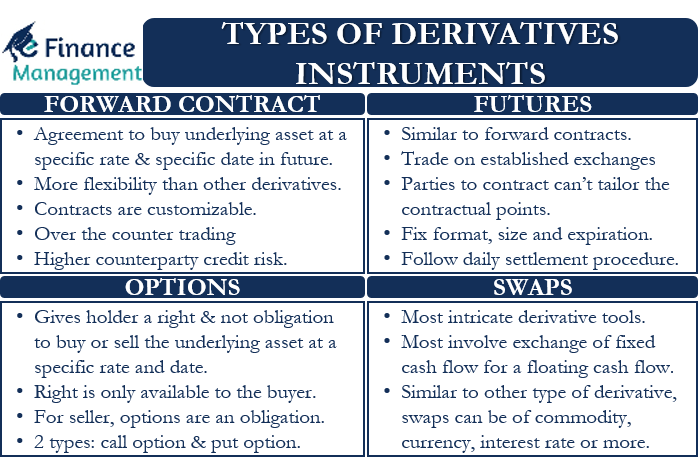

The main types of derivatives are futures forwards options and swaps. A derivative is a financial contract that derives its value from an underlying asset. The hybrid instrument is not measured at fair value through profit or loss.

A separate instrument with the same terms as the embedded derivative would meet the definition of a derivative. A derivative instrument is a subset of financial instrument with mainly three characteristics viz its value changes in response to a change in the underlying variable it requires no or low initial net investment and its settled on a future date. There are derivatives based on stocks or bonds.

A dictionary definition of a derivative is a financial instrument whose performance is based on or derived from the movement of the price of an underlying asset which does not. A derivative security is a financial instrument whose value depends upon the value of another asset. A derivative is set between two or more parties that can.

The payoff for a forward derivative contract in finance is calculated as the difference between the spot price Spot Price A spot price is the current market price of a commodity financial product or derivative product and it is the price at which an investor or trader can buy or sell an asset or security for immediate delivery. In finance a derivative is a contract that derives its value from the performance of an underlying entity. Financial derivatives are financial instruments whose value is tied to a more elementary underlying financial instrument or asset such as a stock bond index or commodity.

Sample 1 Sample 2 Sample 3 Based on 3 documents Examples of Derivative Financial Instruments in a sentence. This underlying entity can be an asset index or interest rate and is often simply called the. Ii their conclusion for commercial purposes.

The parties to the contract take opposite positions as to whether the underlying assets value will rise or fall. By definition a derivative is a financial instrument whose value is dependent on the value of the underlying asset or asset group of assets. This financial instrument is itself usually a contract between two or more parties whose value.

The definition of currency derivatives in relation to. The term derivative refers to a type of financial contract whose value is dependent on an underlying asset group of assets or benchmark. The buyer agrees to purchase the asset on a specific date at a specific price.

Derivative Financial Instruments means any instrument the price of which directly or indirectly depends on the price of securities commodities foreign currencies Securities indices or interest rates other than depository receipts. Derivative financial instrument means a financial instrument future contract swap contract forward contract etc the value or price of which is linked to the value or price or certain goods price of securities currency exchange rate interest rate stock exchange index creditworthiness or another variable. Financial derivatives are used by money managers for various different investment purposes such as hedging speculation and financial risk management.

Finance derivatives are a contract that derives its value from an underlying asset or factor. Derivatives are often used for speculation or for hedging risk. In short the value of a derivative depends on the value of something else.

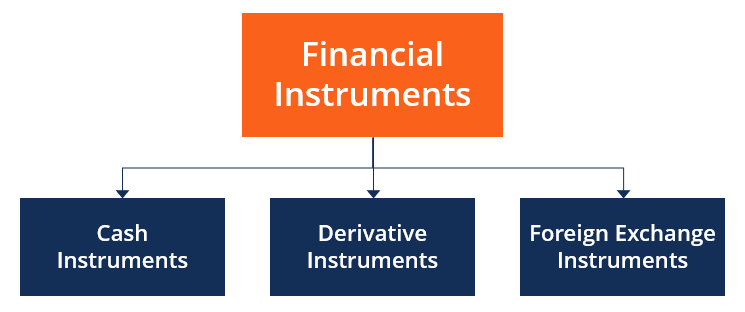

Financial Instruments What It Is Types And More

What Is A Financial Instrument Definition And Examples Market Business News

What Is A Financial Instrument Definition And Examples Market Business News

Financial Instrument Annual Reporting

Financial Instrument Overview Types Asset Classes

What Is A Financial Instrument Definition And Examples Market Business News

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

Belum ada Komentar untuk "derivative instrument finance definition"

Posting Komentar